Inside: How to get the most out of your money by copying the tricks of smart money people. These are the 5 checking account features to look for when opening a new account. Sponsored by First Service Credit Union.

Have you noticed that some people just seem to be good with money?

What’s their secret??

Spoiler alert: there’s no “big secret.”

But that doesn’t mean that there is no strategy!

People Who Are Good with Money Always Do THIS

People who are good with money pay attention to ALL the little details, even things that seem basic, like a checking account.

Checking accounts are a necessity for any family financial portfolio, but they are one of the most overlooked assets. Many people don’t put a lot of thought into their checking account.

However, smart money people always read the fine print when opening a checking account, because all checking accounts are not created equal.

If you’re not careful, you might find that you end up paying money to use YOUR checking account or to access YOUR money!

People who are good with money look for a few specific checking account features to make their money work for them. The good news is that anyone can use these tricks to get the most out of their checking account!

5 Checking Account Must-Haves

These are five features that smart money people look for when choosing a checking account:

1. No Monthly Fees

This is my number one deal-breaker.

You shouldn’t have to pay to have a checking account. Period.

When setting up a checking account, ALWAYS read the fine print. If there is a monthly service fee to open a personal checking account, walk away.

This is one reason I recommend banking with a credit union, like First Service Credit Union.

Unlike banks, credit unions are non-profit, member-owned cooperatives. Their priority is to serve their members, not make a profit.

Credit unions provide a wide range of financial services, just like banks. However, credit unions generally have lower fees and better interest rates.

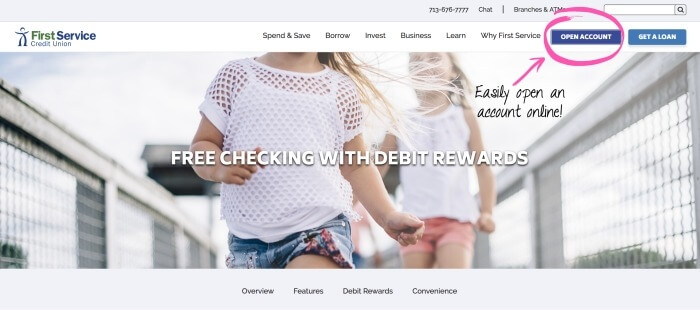

A Free Checking Account from First Service Credit Union truly is free.

2. Low or No Minimum Balance

During college, I needed to set up a new bank account. I decided to check out the bank that my employer used. This was a traditional bank, versus a credit union, and I quickly realized my mistake.

When we got to the fine print, the bank manager mentioned a minimum balance of $5000 for checking accounts.

Wait. What?

It turns out that some banks require you to maintain a minimum balance in your checking account or they’ll charge you an additional monthly fee.

That was enough to make me stop the entire account setup process and walk away.

A high minimum balance seemed to me to be a way to squeeze more money out of me every month. I consider myself to be financially responsible, but who wants to worry about your account dipping below a set amount and then paying for it?!

3. Free ATMs

If you can’t access your money or have to pay for that access, there’s a problem. Some ATMs charge fees of $5 or more! That truly feels like throwing money away.

With First Service Credit Union, you’ll get free access to over 5,000 shared branches and nearly 30,000 shared ATMs available through the CO-OP network of credit unions.

That way you can get your money when you need it, without a fee.

4. Online Banking

In the age of the internet, you should always have access to your account and your money. Make sure that your checking account offers online banking.

I don’t know about you, but “banker’s hours” don’t always fit my schedule. I usually pay bills and handle financial stuff after the kids are in bed and the house is quiet. I need 24/7 access to my accounts to make sure that everything is in order exactly they way I need it to be.

With online banking from First Service Credit Union, you can access your account anytime, from anywhere. Transfer money, manage your accounts, pay bills, and more — without leaving the house or fighting traffic. They also offer mobile banking for another convenient option.

When you sign up for Free Checking with Debit Rewards from First Service Credit Union, your account will come with eStatements, which are not only easy, but better for the planet. Paper statements are available if you prefer, for a small fee.

5. Earn Rewards

When choosing a credit card, points and rewards are a big deciding factor. But what if your checking account could earn you points and rewards too?

With Free Checking with Debit Rewards from First Service Credit Union, you earn 1 point for every dollar you spend with your debit card. Check out some of the exciting rewards:

- Travel — Take a vacation when you redeem your points for airline tickets, hotel rooms, and more!

- Gift Cards — Go on a (free) shopping spree when you redeem your points for gift cards from Amazon®, Best Buy®, and more!

- Entertainment — Hit the town with rewards like shows, sports events, movies, and more!

- Merchandise — Choose specific items on which to redeem your points, from clothing to electronics and thousands of other options!

I already use my credit card to earn money towards travel, so imagine the places our family could go if I used my debit card to earn points for travel too!

Bonus: You can even earn DOUBLE points by using the promo code DOUBLEMYPOINTS and setting up a direct deposit of $500 or greater.

Plus, First Service is giving away $1,500 a week and $50,000 a year with Cash Rewards. Every time you use your debit card or make a transaction, you automatically earn entries! Get full details here.

Make Your Checking Account Do More for You with First Service Credit Union

First Service Credit Union has served the Greater Houston Area for more than 40 years. With 55,000 members, and 11 branches, it’s a trusted name in the community.

And of course, your money is federally insured by the National Credit Union Association.

What I especially liked about First Service Credit Union is that you can become a member and start an account without ever leaving home. That’s right, you can open a free checking account at fscu.com — all from the comfort of your couch! As a mom of three, including a newborn, the convenience factor can’t be beat!

It only takes a few minutes to become a member and sign up for Free Checking with Debit Rewards from First Service Credit Union, and all you need on hand is your driver’s license. It’s seriously that easy!

Click here to get started with Free Checking with Debit Rewards at First Service Credit Union. The sooner you start, the sooner you’ll start earning rewards AND be entered in the weekly and yearly cash drawings!

- Amish Sugar Cookies - April 19, 2024

- Marshmallow Playdough - April 18, 2024

- Homemade Fruit Leather Recipe - April 17, 2024

susan says

Good list for what to look for when selecting a bank. Thanks.