Is there ever a right time to have a baby? Are we ever completely ready?

Even though my husband and I planned for our youngest daughter, there was still a part of me that was secretly terrified!

Of course, we were both thrilled beyond belief with this blessing. But I’ll admit that there were definitely a few worries too, like can we afford a new baby?

I didn’t want worries to dictate our decisions, so always the planner, I took every step I could to make sure that money wouldn’t be an issue.

6 Crucial Financial Planning Tips for Expecting Parents

Find out what your insurance covers BEFORE you get pregnant

Knowing what benefits you’re offered through your insurance program can save you thousands of dollars. Don’t expect your hospital or health care provider to do your homework for you. Plus, if you receive any incorrect bills or overcharges (which is fairly common), you’ll be able to dispute them easily.

If you’re not insured when you find out you’re expecting, there’s good news. Pregnancy is is considered a “qualifying life event” that will allow you to sign up even if you missed open enrollment — whether it be through your employer’s plan or the government marketplace.

Start saving ASAP

When I found out that I was pregnant, my husband and I immediately cut back on unnecessary expenses. With a job that was not guaranteed to be there upon my return, we wanted to be prepared in case that I was unemployed for a time.

You might find it helpful to start a separate “new baby” savings account. Keeping a separate savings account makes it easier to avoid spending that money on other things!

I also highly recommend downloading this FREE ebook: Financial Boot Camp for New Parents to help create a detailed savings strategy for your family. There is a ton of important information packed into the pages of this guide, and it’s presented in a clear and easy-to-read format.

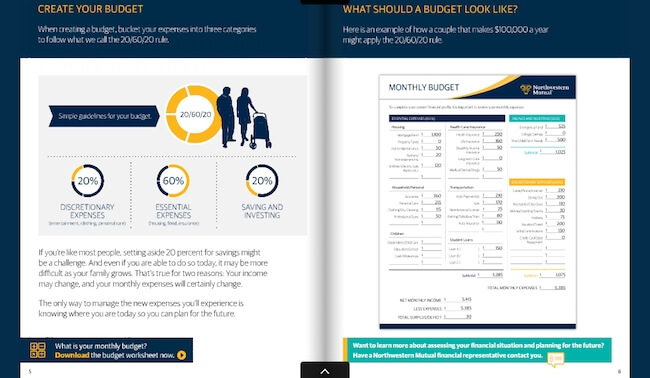

I found the printable monthly budget worksheet particularly helpful:

Download your free copy of Financial Boot Camp for New Parents HERE.

Make a plan with your employer

If you’re a working mom, you need to know your employer’s maternity leave policy. In the U.S., paid leave is not guaranteed for most jobs, and benefits for expectant and new moms vary wildly. Unpaid leave is guaranteed only if you’ve been in a job for over a year at a company with more than 50 employees.

I know how scary it is to tell your boss you’re pregnant, when you’re not sure about the reaction. I also know worrisome it is to have no paid to count on, and limited unpaid leave. However, it is much better to get this conversation out of the way so there are no surprises on that end and you can plan accordingly!

Avoid other life changes if possible

We don’t always have control over everything in life. However, a new baby is a huge life change, even more so than we often anticipate!

Make things easier on yourself by avoiding other life changes in which you have a choice. For example, don’t rush out to buy a new house because you think your growing family needs more space. Our baby actually slept in a crib in our bedroom for the first few months, because it was easier to get to her while I was recovering from an unplanned c-section.

Know what you need…and what you don’t

When you start looking into baby gear, you’ll find out about all kinds of products you never knew existed. From belly bands to track baby kicks to gadgets that claim to interpret a baby’s cries, it’s easy to get carried away.

Before you buy and before you create your baby registry, ask around. What products were lifesavers for your friends and family? What products were a waste of money? This is my own list of baby registry must-haves, as well as things to skip.

Don’t let money decide when is the RIGHT time to have a baby

A new baby is an occasion to celebrate, and your family will never be the same (in a good way)! It’s natural to have financial concerns with such a big change, but money should’t get in the way of enjoying this special moment.

If you plan ahead, you’ll know what to expect…and be ready to handle the unexpected!

YOU MIGHT ALSO LIKE: The One Lifestyle Change that Allowed me to be a Stay at Home Mom

This is a sponsored conversation written by me on behalf of Northwestern Mutual. The opinions and text are all mine.

- Amish Sugar Cookies - April 19, 2024

- Marshmallow Playdough - April 18, 2024

- Homemade Fruit Leather Recipe - April 17, 2024