This is a sponsored post written by me on behalf of Visa.

It’s almost the end of the year, which means it’s time to start thinking about your healthcare benefits in 2017! I’m working with Visa to help explain two common healthcare plans as well as the advantages of a Visa Healthcare card which may be offered with these plans.

As the person in our family who manages our healthcare benefits, I know how confusing it can be trying to decipher all of the available options. I’ll admit there’s definitely the temptation to “just pick something” and be done with it!

However, it is so important to take your time and make sure that you select the best plan for you and your family. It could save you a lot of money in the long run!

While looking over your employer provided health insurance information, perhaps you saw these acronyms listed: FSA and/or HSA. If you purchase coverage through the Marketplace, you might also notice the option to select an HSA plan.

So what does that mean?

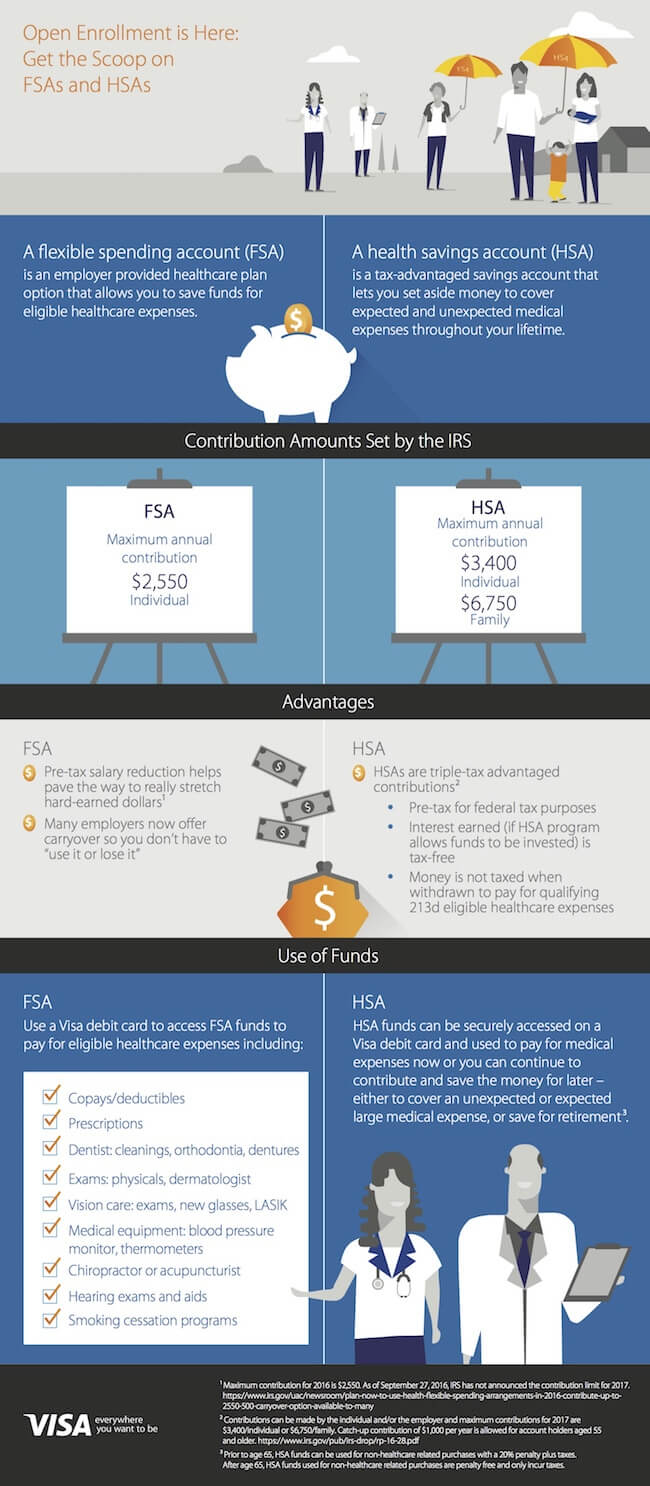

What are FSAs and HSAs?

FSA (Flexible Spending Account)

An FSA is an employer-provided healthcare plan that allows you to save funds for eligible healthcare expenses, such as co-pays, deductibles, and prescription medications. You get to decide how much of your paycheck, pre-tax, you want to contribute to your FSA, within the cap set by your employer.

HSA (Health Savings Account)

An HSA allows you to set aside money on a pre-tax basis to pay for qualified medical expenses if you have a high deductible health insurance plan. You can get an HSA on your own or through your employer. Unused HSA funds rollover to future years, even if you change jobs or stop working. Your HSA account may even earn interest.

What is a high deductible health insurance plan?

A high deductible heath plan (HDHP) may be suitable for individuals or families that don’t normally have a lot of medical issues. With an HDHP, your premiums are generally lower than a traditional health insurance plan. However, you typically pay more medical expenses yourself (your deductible) before insurance coverage kicks in.

What are the benefits of FSA or HSA?

- Save a portion of your salary pre-tax to pay for qualified healthcare expenses in an FSA provided by your employer and stretch your hard-earned dollars.

- Enjoy a triple-tax advantage with an HSA – (1) Contributions are tax-deductible (2) Money withdrawn to pay for eligible medical expenses is tax-free (3) Interest earned on funds invested is tax-free.

- Access your funds in an FSA or HSA conveniently and securely with a Visa Healthcare card.

Check out the infographic below and get the scoop on FSAs and HSAs!

Whether you decide to go with an FSA or an HSA, a Visa Healthcare card makes paying for medical expenses simple.

You don’t often see the word simple used in the same sentence as medical expenses! However, a Visa Healthcare card is about as easy as it gets. Present your Visa Healthcare card as you would a debit card when paying for qualified medical expenses. It draws funds directly from your Flexible Spending Account or Health Savings Account conveniently and securely.

For added convenience, most pharmacies, grocery stores and other retailers that sell healthcare products have the capability to distinguish between covered items and non-covered items when you pay for them, so you don’t have to wonder whether something is covered or not. By using a Visa Healthcare card at these locations, you no longer have to pay out-of-pocket and then submit receipts to be reimbursed for your medical expenses, saving you time and money!

CLICK HERE to learn more about the Visa Healthcare card and how it might be the right choice for you and your family!

- Amish Sugar Cookies - April 19, 2024

- Marshmallow Playdough - April 18, 2024

- Homemade Fruit Leather Recipe - April 17, 2024

Leave a Reply